Table of Contents

Overview

Insurance is a financial tool designed to safeguard against monetary risksRisk Risk is a loss that occurs to the insured individual or object. Various bad possibilities could happen to someone. associated with unforeseen events, such as death, accidents, or deteriorating health conditions.

As more people visit, they begin to realize the significance of purchasing insurance products to safeguard their finances against unforeseen losses.

This has led numerous insurance companies to offer a range of insurance products, each with different facilities and benefits, to cater to the diverse needs of their customers.

Fire insurance is a widely utilized type of policyPolicy The policy is a binding agreement and is agreed upon by the insurance company and policyholder in writing. An agreement made by the policyholder with an insurance company. specifically designed to protect properties, including houses, offices, and other buildings.

Then what is fire insurance, what are the benefits and how to make a claimClaim The demands are given by the insurance policyholder to get the right properly so that the insurer pays the conditions according to the existing procedure.? Check out the full details below.

Definition of Fire Insurance

Fire insurance is a form of coverage that offers protection against damages to buildings or property resulting from fire, lightning, explosions, aircraft impact, and smoke damage.

Typically, fire insurance coverage encompasses property such as buildings, including their furniture and equipment, machinery, inventory, merchandise, and other items not specifically excluded in the policy’s exclusions.

The insuredInsured A person who is legally listed in the insurance policy to receive benefits from the policy. A person whose life/health is covered in accordance with an insurance agreement or contract. or user of fire insurance is:

- Individuals or companies may own various types of properties, including residential buildings, offices, shops, hospitals, hotels, factories, warehouses, and other structures.

- Banks offering home ownership loans.

Fire insurance not only provides coverage during a fire disaster but also under special conditions that protect your assets and investments. For instance, this includes events such as riots, lightning strikes, floods, or an airplane crash.

Benefits of Having Fire Insurance

Having fire insurance provides a safeguard against potential losses that may arise from a fire incident affecting your property. Additionally, fire insurance offers several benefits, including:

Benefits of Having Fire Insurance No.1

InsuranceWhat.com

Financial Protection

The primary benefit of fire insurance is the financial protection it provides. Fires can cause extensive damage to property, leading to substantial financial losses. Fire insurance covers the cost of repairing or rebuilding damaged property, ensuring that you do not have to bear the financial burden alone. This coverage extends to residential buildings, commercial spaces, and industrial premises, providing a safety net for various types of properties.

Having fire insurance ensures that your financial burden is minimized in the event of damage. Typically, you would only be responsible for paying a portion of the repair costs, with the insurance company covering the remainder.

Benefits of Having Fire Insurance No.2

InsuranceWhat.com

Support for Business Continuity

For businesses, fire insurance is essential for maintaining continuity in the event of a fire. The policy can cover the cost of temporary relocation, loss of income, and additional expenses incurred during the rebuilding process. This support helps businesses recover more quickly and minimizes the disruption caused by fire-related incidents.

With the protection of fire insurance, you also feel safer and more confident as a property owner. So, if there is really a fire when you already have fire insurance, at least there will be a reimbursement tone from the insurance that reduces the burden of your losses.

Benefits of Having Fire Insurance No.3

InsuranceWhat.com

Customizable PoliciesPolicy The policy is a binding agreement and is agreed upon by the insurance company and policyholder in writing. An agreement made by the policyholder with an insurance company.

Fire insurance policiesInsurance policy An agreement between the policyholder and the insurance company to perform the obligations as agreed by both parties. offer high customization, enabling you to adjust the coverage to fit your particular needs. You have the option to select from a range of add-on covers, including protection for consequential losses, extra expenses incurred during reconstruction, and particular risks such as earthquakes or floods. This adaptability guaranteesWarranty Statement A statement issued by a potential customer regarding the condition of the person or thing insured. that you receive thorough protection tailored to your specific requirements.

Benefits of Having Fire Insurance No.4

InsuranceWhat.com

Affordable PremiumsPremium The money that must be paid at a certain time is the obligation of the insurance policyholder. The amount of premium paid is determined by the policy and approval of the insurance company in accordance with the conditions of the insured. The nominal payment approved by policyholders and insurance companies. Premium payment will be made according to the agreement, it can be monthly, yearly, or according to the agreement.

Fire insurance policies, despite their comprehensive coverage, are typically affordable. Premiums are calculated considering various factors, including the property type, location, construction materials, occupancy, and existing fire prevention measures. Investing in fire insurance provides substantial financial protection at a manageable expense.

Benefits of Having Fire Insurance No.5

InsuranceWhat.com

Expansion of GuaranteeWarranty Statement A statement issued by a potential customer regarding the condition of the person or thing insured.

In addition to standard insurance guarantees, home fire insurance policies often include expanded coverage that protects against risks such as riots, lightning strikes, terrorism, floods, and aircraft accidents.

Certainly, this scenario offers advantages and peace of mind, as disasters can occur unexpectedly and in any location.

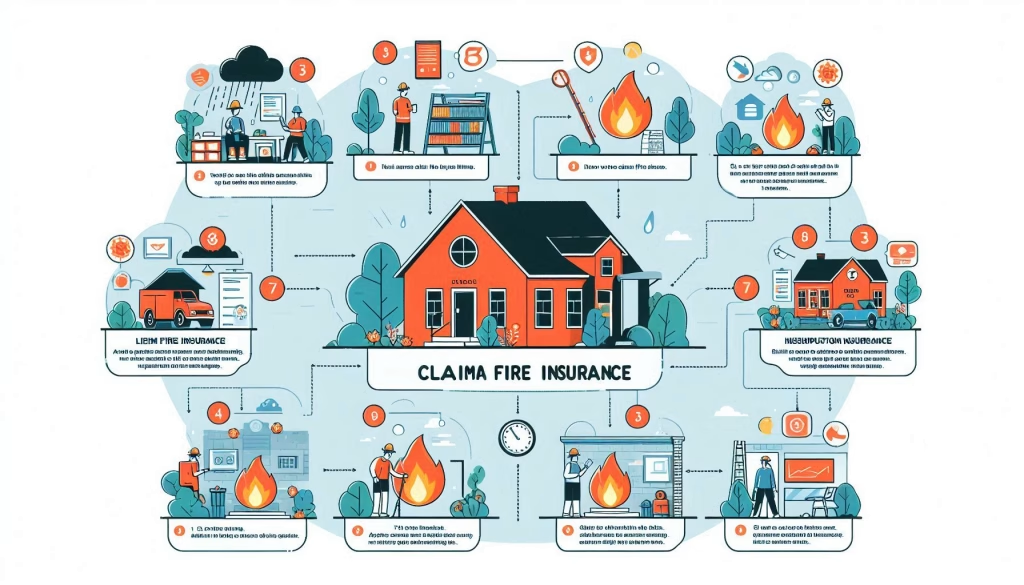

How to Claim Fire Insurance

To file a fire insurance claimInsurance claim A formal request made to the insurance company for compensation based on the terms of the insurance policy or agreement., you must be aware of at least five key steps, which are explained as follows:

How to Claim Fire Insurance No.1

InsuranceWhat.com

Notify Your Insurance Company Immediately

The first step in the claimsClaim The demands are given by the insurance policyholder to get the right properly so that the insurer pays the conditions according to the existing procedure. process is to notify your insurance company as soon as possible after the fire. Most insurersInsurer A person who is legally listed in the insurance policy to make premium payments for that policy. have 24-hour emergency hotlines for reporting claims. Prompt notification is crucial as it sets the claims process in motion and helps prevent any delays. Be prepared to provide details about the incident, including the date, time, and extent of the damage.

How to Claim Fire Insurance No.2

InsuranceWhat.com

Secure the Property

After notifying your insurerInsurer A person who is legally listed in the insurance policy to make premium payments for that policy., take steps to secure your property to prevent further damage. This might involve boarding up windows, covering damaged roofs, or hiring security to protect the site. Your insurance policyInsurance policy An agreement between the policyholder and the insurance company to perform the obligations as agreed by both parties. may require you to mitigate further damage, so taking these steps is essential. Document any actions you take with photos and receipts, as these may be needed for your claim.

How to Claim Fire Insurance No.3

InsuranceWhat.com

Document the Damage

Thorough documentation is critical for a successful fire insurance claim. Take detailed photographs and videos of all damaged areas and items. Make a list of damaged or destroyed property, including descriptions, purchase dates, and estimated values. This inventory will be crucial when filing your claim and negotiating with your insurer.

How to Claim Fire Insurance No.4

InsuranceWhat.com

Obtain a Copy of the Fire Report

Contact your local fire department to obtain a copy of the fire report. This document provides an official account of the incident and is often required by insurance companies to process your claim.

After reporting a fire, it is also necessary to complete a report or written statement detailing the losses or damages incurred from the disaster. Typically, the forms required to be filled out pertain to:

- Please provide the location, date, and time of the fire or incident.

- Cause of fire or damage.

- The insured loss encompasses all items that are burned, destroyed, lost, damaged, and those that can still be salvaged.

- Additional information that the insured deems necessary to provide to the insurance company.

How to Claim Fire Insurance No.5

InsuranceWhat.com

Policy Identification Stages

Once the policy identification results are validated, the insurance company will proceed with field research to ascertain the actual events.

The insurance company will explore several basic pieces of information, which include:

- The causes of fire and damage.

- A location where a fire or damage transpires.

- The extent of losses incurred.

- The remaining value of the building, goods, or machinery that has not been burned or damaged.

Once a claim is deemed valid, the insurance company will notify the customer of the compensation amount to be paid, fulfilling the company’s obligation.

How to Claim Fire Insurance No.6

InsuranceWhat.com

Claim Submission Results

Once an agreement on the compensation amount is made, the insurance company will proceed to prepare the claim payment. The compensation will be paid out no later than the deadline specified in the policy or as per the agreed terms.

The Conclusion

Additional Protection Is Important

Filing a fire insurance claim can be a complex and stressful process, but understanding the steps involved can make it more manageable. By notifying your insurer promptly, documenting the damage thoroughly, and staying proactive throughout the process, you can maximize your chances of a successful claim. Fire insurance is there to help you recover from a devastating event, and knowing how to claim it effectively is key to getting back on your feet.

Do you think you have other ideas about Fire Insurance Explained: Coverage, Benefits, and Claims Process? You can comment and share your thoughts below, or discuss more in the InsuranceWhat Forum. Also, read more articles about GLOBAL INSURANCE or other interesting insurance topic articles only at InsuranceWhat.com.